Inflation has always been a big talking point when it comes to investments and rightfully so. Numerous studies and articles have been published illustrating the possible destructive effects that inflation can have on your investment.

In this article we will look at exactly how destructive inflation can be when you are saving towards retirement. We will also focus on the impact that recurring investments with different annual contribution rates can have on investments with different risk profiles.The following assumptions are used:

• A recurring investment of R36 000 pa which equates to R3 000 pm

• Contributions will start at age 26 and continue until the age of 64 (39 year investment term)

• Inflation: 7% pa

• Total fee: 0.75% pa (excluding fund specific fees)

Do you know how much you are “really” contributing?

Let’s start off with a simple question. Have you ever received an annual salary increase? I assume the majority of us would hopefully answer yes. Right, next question, once you’ve received your higher annual salary – how many of you actually thought of increasing your annual retirement contribution? I’m pretty sure that this is where quite a number of us will not be able to say that we did.

As we know, every decision in life has consequences. So let’s firstly look at the consequence of not adequately increasing your contribution rate.

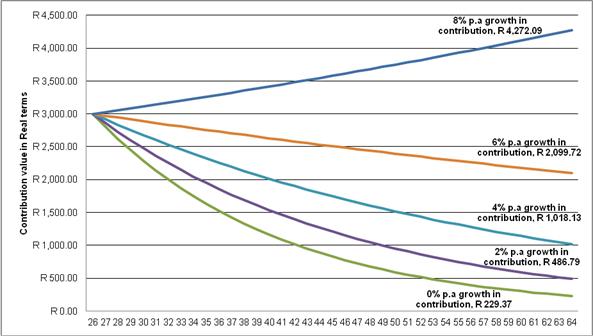

In the following section we illustrate - using different annual contribution rates - how much your monthly contribution in 39 years is worth today in real terms.

Assuming a monthly contribution of R3 000 with a 0% escalation rate, over the next 39 years, your contribution in real terms is worth R229.37 today. The value of all other contributions with an escalation rate below inflation (i.e. 7% in this illustration) renders similar results – where your actual contribution diminishes in real terms over time. Had you decided to increase this same contribution at least in line with, or above inflation (i.e. 8% in this illustration) then this is avoided plus your contribution in 39 years’ time is worth R4 272.09 in today’s terms (see graph above).

So if you fail to adjust your contributions in line with inflation the amount you are contributing could be substantially less than what you might think it is worth.

Your contribution rate and its impact on your lump sum retirement benefit

Now that we have seen how inflation can erode your monthly contributions in real terms we will now look at the impact that different escalation rates will have on your lump sum benefit at retirement. Assuming you are a moderate investor who decides to grow your contribution by 0% p.a. you will have a lump sum investment value of R1,668,870.15 (assuming a real return of 4.84%) at the end of your 39 year investment term.

|

Investment value (in Rand) at different contribution rates – value (in real terms) at age 65 |

|||||

|

Contribution rate: |

0% |

4% |

6% |

8% |

Difference between 0% and 8% (in Rand terms) |

|

Moderate |

R1,668,870.15 |

R2,472,861.03 |

R3,136,059.84 |

R4,102,142.24 |

R2,433,272.09 |

On the other hand, if you decide to grow your contribution by 8% p.a. your investment value will be R4,102,142.24. This equates to a rand difference of R2,433,272.09 or a percentage difference of just over 145%. The same principle applies across all other risk profiles, the only difference being that the rand and percentage increases differ.

Investing more aggressively

In this section we illustrate how investing more

aggressively is another consideration when it comes to saving for retirement,

especially if you decide to start investing early and are able to stomach

short-term market volatility which diminishes over time. We then link the different contribution rates

and risk profiled investments to illustrate how large an impact this will have

in the long-term.

|

Investment value (in Rand) at different contribution rates – value at age 65 |

||||

|

Contribution rate: |

0% |

4% |

6% |

8% |

|

Conservative |

R935,781.45 |

R1,478,169.41 |

R1,952,621.42 |

R2,669,593.28 |

|

Moderate |

R1,668,870.15 |

R2,472,861.03 |

R3,136,059.84 |

R4,102,142.24 |

|

Aggressive |

R3,028,715.39 |

R4,243,795.88 |

R5,196,700.43 |

R6,538,398.69 |

From the table above you can, in certain instances, invest more aggressively without actually increasing your contribution rate. The cells highlighted in red illustrate how close the final investment value of a conservative investment with an 8% escalation rate is to a moderate investment with a 4% escalation rate. The same applies to a moderate investment with a 6% escalation rate and an aggressive investment with no growth in contributions (cells highlighted in green).

Of course investing more aggressively and at the same time increasing your contribution rate leads to even higher returns over time. This however is a function of your ability to firstly stomach the volatility and risks associated with investing more aggressively, your time horizon to retirement and your means to contribute more.

In summary, most people contribute to some sort of investment on a monthly basis, but how many are ensuring their contributions are keeping up with inflation? Many investors also tend to invest too conservatively – despite having a relatively long investment horizon – which can also have a dramatic impact on their nest egg.

As a result it is important that you – in conjunction with your financial intermediary – look at these two important considerations when planning for your retirement.

* This report was prepared by Melvyn Lloyd, Investment Analyst, Glacier by Sanlam. Glacier ICE provided the figures used in this article.